If you’ve already filed your tax return and are waiting for your money, checking your refund status is simple and quick. The Internal Revenue Service provides an official tracking system that allows taxpayers across the United States to see exactly where their refund stands.

Whether you filed electronically or by paper, this guide will help you understand how to track your IRS refund and what each status means.

When Can You Check Your IRS Refund?

You can usually start checking your refund status:

Within 24 hours after e-filing your tax return

About 4 weeks after mailing a paper return

The IRS updates its system daily, typically overnight.

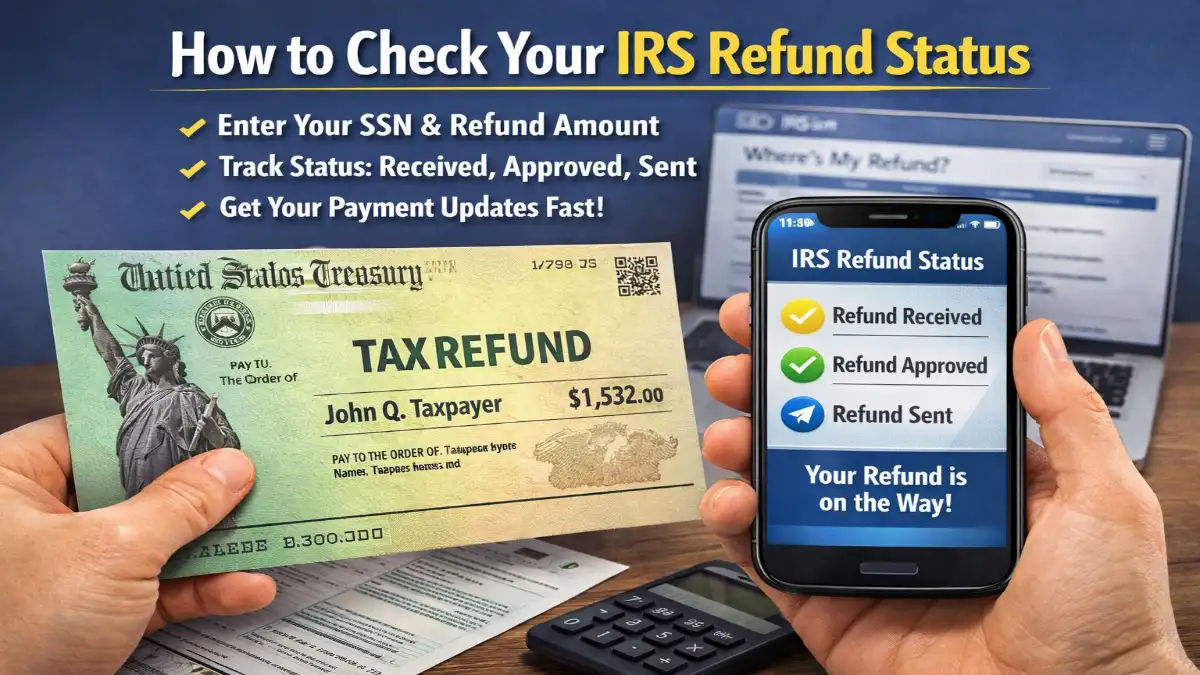

Information You’ll Need

Before checking your refund, keep these details ready:

Your Social Security number or ITIN

Your filing status (single, married, head of household)

The exact refund amount shown on your tax return

Having accurate information ensures quick access.

Understanding IRS Refund Status Messages

When you check your refund, you’ll typically see one of these updates:

Refund Received

The IRS has your return and is processing it.

Refund Approved

Your refund has been approved and is being prepared for payment.

Refund Sent

Your money has been issued, either by direct deposit or mailed check.

Once the status shows “Sent,” most people receive their refund within a few days.

How Long Does It Usually Take?

For most taxpayers who file electronically and choose direct deposit, refunds arrive within about 21 days. Paper returns can take longer, sometimes several weeks.

Delays may happen if:

There are errors on your return

Extra identity verification is required

You claimed certain tax credits needing review

What to Do If Your Refund Is Delayed

If your refund is taking longer than expected:

Double-check your filing details

Wait at least 21 days before contacting the IRS

Monitor updates regularly

In many cases, delays resolve on their own after processing is complete.

Tips to Get Refunds Faster in the Future

To speed up refunds next time:

File electronically

Use direct deposit

Avoid mistakes on your return

Submit early in tax season

These steps greatly reduce waiting time.

Final Thoughts

Checking your IRS refund status is easy and helps you stay informed about when your money will arrive. By understanding the process and what each update means, you can avoid stress and plan your finances better during tax season.