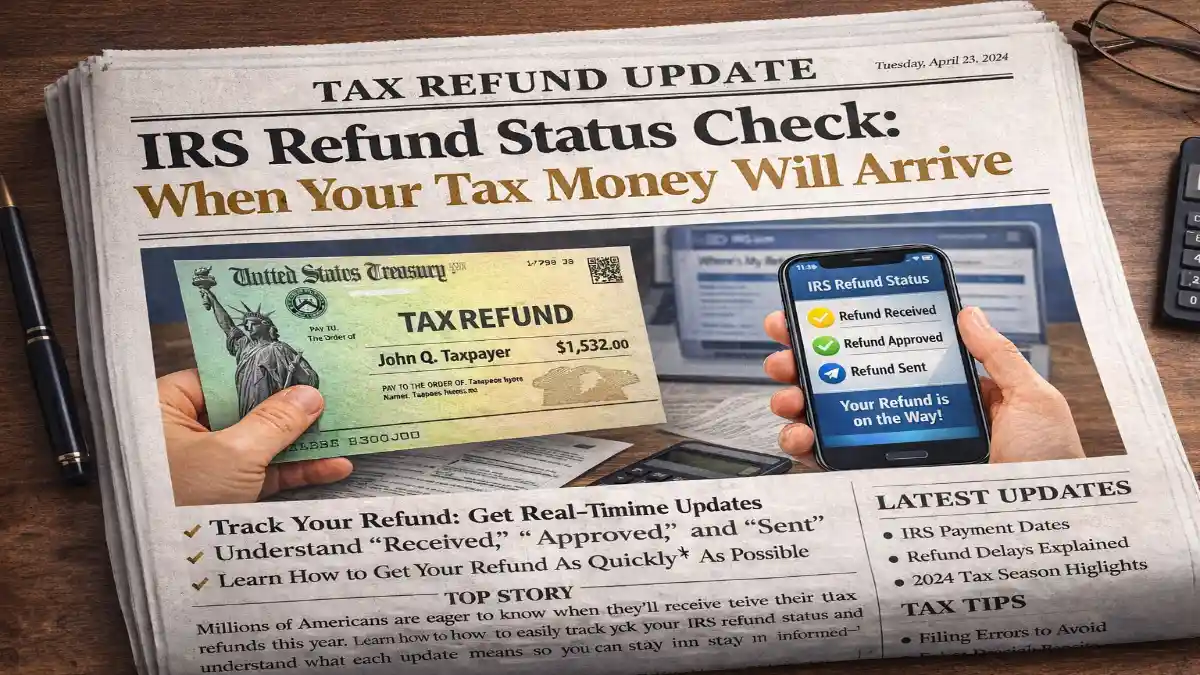

As tax season moves forward, millions of Americans are closely watching their refunds and wondering when their money will reach their bank accounts. The Internal Revenue Service offers a simple way to track refund progress, helping taxpayers across the United States stay informed and avoid unnecessary stress.

Knowing how to check your refund status and understanding what each update means can make the waiting process much easier.

How Soon Can You Check Your IRS Refund Status?

Most taxpayers can begin tracking their refund:

Within 24 hours after filing electronically

Around 4 weeks after mailing a paper return

The IRS updates its system once daily, usually overnight, so checking once a day is enough.

What Information You Need to Track Your Refund

To check your refund status, you’ll need:

Your Social Security number or tax identification number

Your filing status (single, married filing jointly, etc.)

The exact refund amount from your tax return

Entering the correct details ensures quick access to your refund information.

Understanding the IRS Refund Status Messages

When checking your refund, you’ll usually see one of these three updates:

Refund Received

The IRS has your return and is processing it.

Refund Approved

Your refund has been approved and is being prepared for payment.

Refund Sent

Your refund has been issued through direct deposit or mailed check.

Once the status shows “Sent,” most people receive their money within a few business days.

How Long Does It Take to Get Your Refund?

For most electronic filers who choose direct deposit, refunds typically arrive within about 21 days. Some may receive it even sooner.

Refunds can take longer if:

There are errors in the return

Extra identity verification is required

Certain tax credits are claimed that need review

Paper returns may take several weeks longer to process.

What to Do If Your Refund Is Delayed

If your refund is taking more than 21 days:

Continue checking your status regularly

Make sure all personal and banking information is correct

Wait for any IRS notices or requests for documents

Many delays resolve automatically once processing is complete.

Tips to Get Your Refund Faster Next Time

To speed up future refunds:

File your tax return electronically

Choose direct deposit instead of a mailed check

Double-check for mistakes

File early in the tax season

These steps significantly reduce processing time.

Why Tracking Your Refund Matters

Monitoring your refund status helps you:

Plan your finances better

Avoid missed payments or budgeting issues

Catch problems early if something goes wrong

It gives peace of mind during tax season.

Final Thoughts

Checking your IRS refund status is quick, easy, and helps you stay updated on when your tax money will arrive. With most refunds issued within a few weeks for electronic filers, staying informed ensures there are no surprises.